Executive Summary

Determining a fair market value (FMV) for investment, sale, or acquisition is a critical aspect of financial analysis and decision-making. Comparable Company Analysis (CCA), commonly referred to as “comps,” is a relative valuation method that compares the financial metrics of similar companies to ascertain the value of a target company.

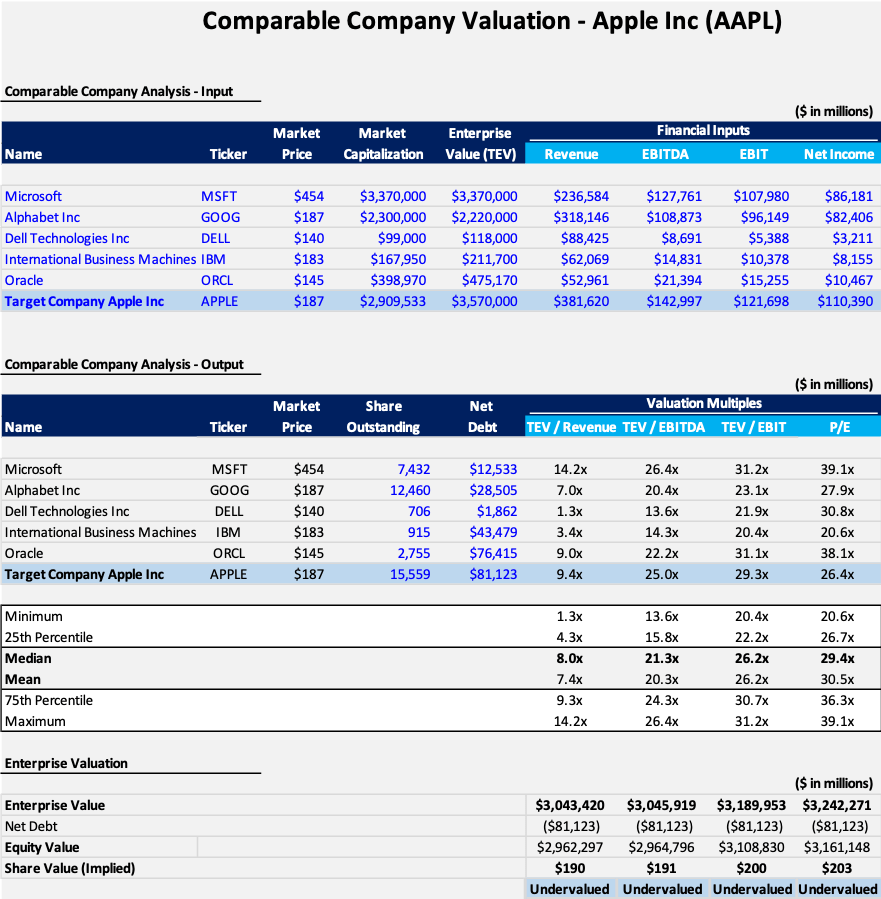

This paper presents a detailed Comparable Company Analysis (CCA) valuation of Apple Inc. (AAPL), outlining each step involved in the process of performing a valuation. The purpose of this analysis is to provide a comprehensive benchmark that aids in making informed investment decisions regarding Apple Inc. By comparing Apple’s financial metrics with those of its industry peers, this analysis offers insights into the market position and valuation, ensuring robust and data-driven investment strategies.

Peer Group – Comparable Companies

- Microsoft

Microsoft Corporation, founded in 1975 , is a global leader in software, services, devices, and solutions. Renowned for its flagship products such as Windows operating system, Office suite, and Azure cloud services, Microsoft drives innovation across various technology sectors. The company is headquartered in Redmond, Washington, and has a strong global presence, serving millions of customers worldwide.

2. Alphabet Inc

Alphabet Inc. (parent company of Google), is a global technology conglomerate. Alphabet oversees a diverse range of subsidiaries, including Google Search, YouTube, and Waymo. The company is at the forefront of innovation in internet services, artificial intelligence, autonomous vehicles, and more. Alphabet’s mission is to organize the world’s information and make it universally accessible and useful.

3. Dell Technologies Inc

Dell Technologies, founded in 1984 by Michael Dell, is a leading global provider of computer technology solutions. Dell specializes in hardware, software, and IT services, including personal computers, servers, storage devices, and cloud solutions. The company’s key capabilities encompass end-to-end IT infrastructure, cybersecurity, and digital transformation services.

4. IBM Corporation

IBM (International Business Machines Corporation), founded in 1911, is a global leader in technology and consulting services. Headquartered in Armonk, New York, IBM specializes in cloud computing, artificial intelligence, blockchain, and quantum computing. The company’s key capabilities include IT infrastructure, software solutions, and enterprise consulting, with a strong emphasis on innovation and research.

5.Oracle Corporation

Oracle Corporation is a global leader in database software, cloud solutions, and enterprise software products. Headquartered in Austin, Texas, Oracle offers a comprehensive suite of applications, platform services, and engineered systems. The company’s key capabilities include cloud infrastructure, database management, enterprise resource planning (ERP), and customer relationship management (CRM).

6.Apple Inc (Target Company)

Apple Inc. is a global leader in consumer electronics, software, and services. Headquartered in Cupertino, California, Apple is renowned for its innovative products such as the iPhone, iPad, Mac computers, and Apple Watch, along with its software ecosystems like iOS and macOS. The company’s key capabilities include hardware design, software development, and seamless integration of technology and services.

Process in Performing Comparable Company Valuation for Apple Inc

Apple Inc. Enterprise Valuation Estimation

- Enterprise-to-EBITDA (EV/EBITDA) multiple

- ‘Peer groups’ median EV/EBITDA multiple = 21.3x

- Apple Inc EBITDA = $142,997 MM

- Estimated Value (Enterprise – to – EBITDA) = $3,045,919 MM or $3.04 trillion

- Enterprise-to-EBITDA (EV/EBITDA) multiple

- ‘Peer groups’ median EV/EBIT multiple = 26.2x

- Apple Inc EBIT = $121,698

- Estimated Value (Enterprise – to – EBITD) = $3,189,953 MM or $3.189 trillion

- Enterprise-to-Sales (EV/Sales) multiple

- ‘Peer groups’ median EV/Sales multiple =8.0x

- Apple Inc Sales =$381,620 MM

- Estimated Value (Enterprise – to – Sales) = $3,043,420 MM or $3.04 trillion

- Price-to-Earning (P/E) multiple

- ‘Peer groups’ median P/E multiple =29.4x

- Apple Inc Net Income = $110,390 MM

- Estimated Value (Price – to – Earning) = $3.4242,271 MM or $3.42 trillion

Conclusion

The Comparable Company Analysis (CCA) of Apple Inc. reveals that the company’s estimated enterprise value, based on four different valuation multiples, ranges between $3.04 trillion and $3.42 trillion. This analysis leads to a share price range of $190 to $ 203. These figures suggest that Apple Inc. is currently undervalued (Current Price $187 as of May 23,2024) and may have potential growth, supported by its consistent financial performance, market leadership, and growth prospects. These insights provide a strong foundation for making informed investment decisions, affirming that Apple Inc. is a valuable addition to any investment portfolio.

However, it is important to conduct a thorough review of these valuation results and adjust if necessary based on qualitative factors, recent market trends, competitive advantages, industry trends, and other relevant considerations. By incorporating these factors, investors can ensure a more comprehensive and accurate assessment of Apple Inc.’s true market value, reinforcing informed and strategic investment decisions.