Introduction

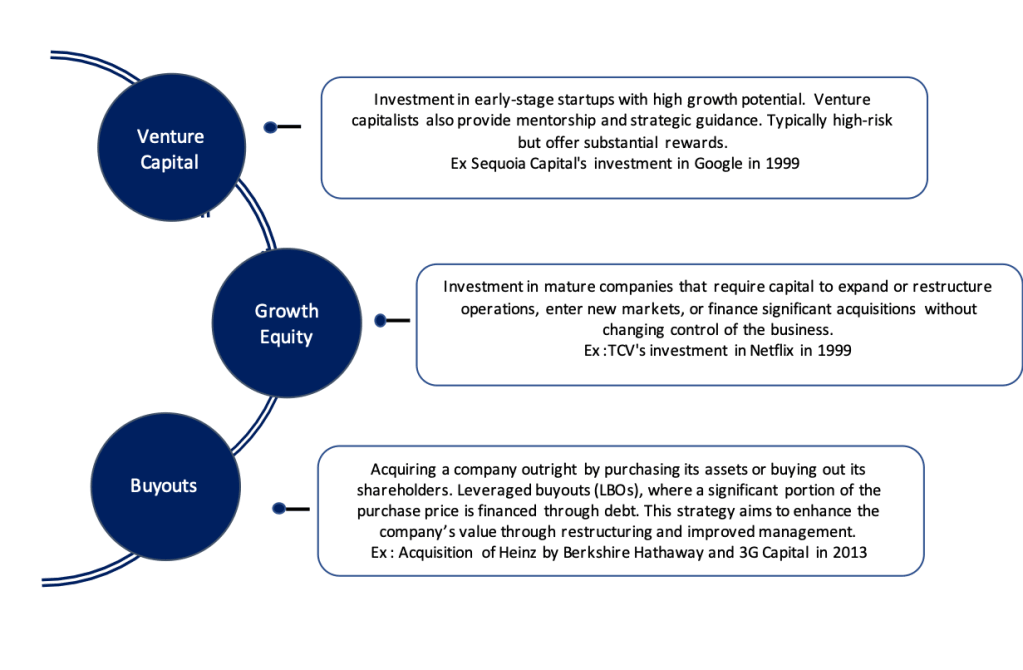

Private equity (PE) has emerged as a pivotal force in the global financial markets, offering an alternative investment avenue that contrasts sharply with public market investing. Defined by its focus on investing in private companies or taking public companies private, private equity encompasses a wide range of strategies, including venture capital, growth equity, buyouts, and mezzanine financing. This paper aims to explore the fundamentals of private equity, its investment process, key players, benefits, risks, and its broader impact on the economy.

Private Equity Investment Types

Private Equity Participants

· Private Equity Firms: Manage private equity funds and are responsible for making investment decisions, managing portfolio companies, and executing exit strategies. Blackstone, KKR, and Carlyle Group.

· Limited Partners (LPs): investors who provide the capital for private equity funds. They include pension funds, endowments, insurance companies, family offices, and high-net-worth individuals. LPs typically have limited liability and do not participate in the day-to-day management of the funds

· General Partners (GPs): The managers of private equity funds. They are responsible for sourcing deals, conducting due diligence, and managing the investments. GPs usually invest their own capital alongside that of the LPs.

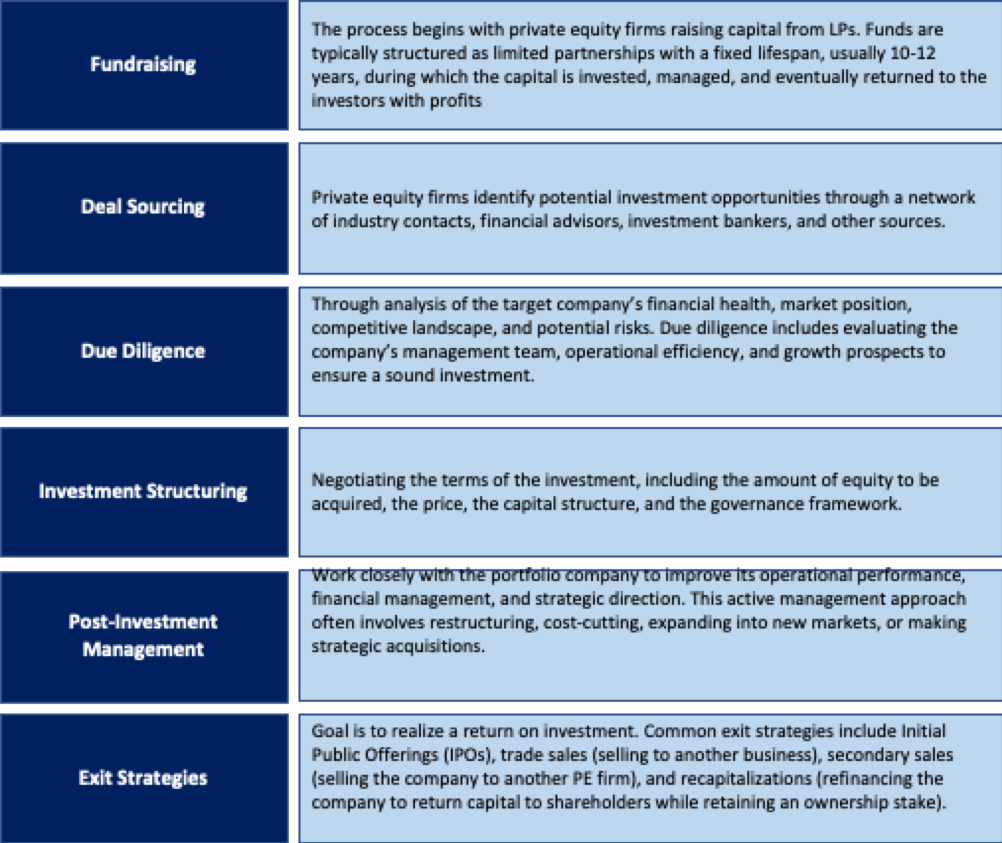

Private Equity Investment Process

Private Equity – Leveraged Buyouts (LBO)

- Private Equity firm in a leveraged buyout (LBO) often referred to as a “financial sponsor” and acquires a target company with a significant portion of the purchase price funded using debt.

- The reliance on debt is one of the core drivers of returns in an LBO investment.

- Paydown of debt (or principal amortization) over the course of the holding period contributes to higher returns on the LBO investment.

- Private Equity (financial sponsor) operates the post-LBO company for around 4 to 7 years

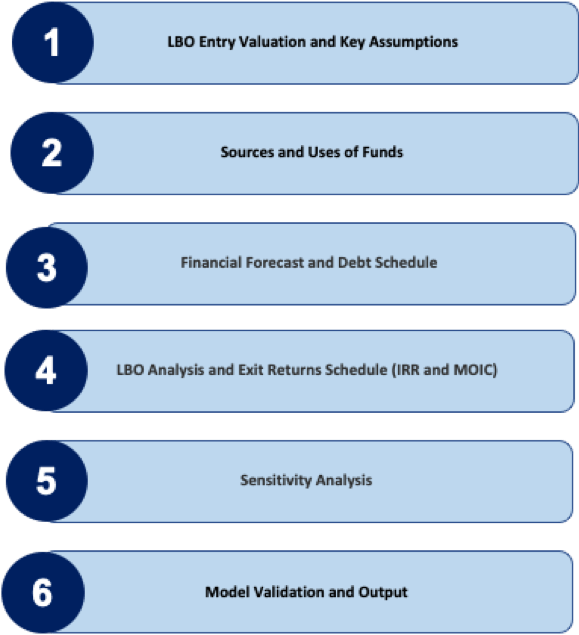

LBO Model

LBO Modeling is a method to measure the implied returns on a leveraged buyout transaction (LBO), which is a specialized type of acquisition where a substantial percentage of the purchase price is funded using debt.

Step 1. LBO Entry Valuation

Pre-LBO Entry Equity Value and Enterprise Value

First step to building an LBO model is to calculate the implied entry valuation based on an entry multiple assumption.

Entry Purchase Enterprise Value (TEV) = LTM EBITDA × Entry Multiple

EBITDA Margin (%) = LTM EBITDA ÷ LTM Revenue

Step 2. Sources and Uses of Funds Table

The next step is to create the sources & uses schedule

Uses: The “Uses” side calculates the total amount of capital required to make the acquisition.

Total Uses = Entry Purchase Enterprise Value (TEV) + Transaction Costs (M&A Advisory Fees, Legal Fees, and Consulting Fees) + Financing Fees (Debt Issuance Costs (Underwriting Fees)

Sources: The “Sources” side details how exactly the deal is going to be funded, including the required amount of debt and equity financing.

Total Sources = Debt Capital + Sponsor Equity

- Debt Financing = Leverage Multiple × LTM EBITDA

- Sponsor Equity = Total Uses – Debt Financing

Cash Free Debt Free (CFDF) is a transaction structure where the buyer does not assume any debt on the seller’s balance sheet, nor gets to keep any leftover cash.If a deal is structured as CFDF, the purchase price is the enterprise value to the buyer.

LBO Financing Assumptions

- Transaction Fees % TEV = 2.0%

- Financing Fees % Total Debt = 2.0%

Step 3. Financial Forecast and Debt Schedule

- The company’s financial performance is projected for a minimum five-year time horizon.

- A complete 3-Statement model is required for the LBO assumptions

- The debt schedule is used to base on how sources side fund has been used

- Revolver Drawdown / (Paydown)

- Principal Amortization (i.e. Mandatory Repayment)

- Cash Sweep (i.e. Optional Prepayment)

- Interest Expense Schedule

Free Cash Flow (FCF) = Net Income + D&A –Capex – Change in NWC

Step 4. LBO Exit Returns Schedule (IRR and MOIC)

Exit Valuation ➝ Post-LBO Exit Equity Value and Enterprise Value of the Target Company

The realization of the investment by the financial sponsor

- Exit Enterprise Value (TEV) = Exit Year EBITDA × Exit Multiple

- Conservative assumption – Exit multiple = Purchase multiple

- Equity Value (Exit)= Exit Enterprise Value – Ending Year Net Debt

- Max Initial Equity Investment by Sponsors = Exit Equity Value/(1+ Minimum Required Annual Return)^(End Period – Start Period)

- Max Initial Transaction Value = Max Initial Equity Investment by Sponsors + Initial Debt Investment based on Leverage Ratio

- Max offer Price = (Max Initial Transaction Value – Net Debt @ start)/# of Outstanding shares

LBO Return Metrics: Internal Rate of Return (IRR) and Multiple on Invested Capital (MOIC)

The Internal Rate of Return (IRR) is the annualized interest rate at which the initial capital investment must have grown to reach the ending value from the beginning value.

- The internal rate of return (IRR) is the annualized yield on an investment, with the effects of compounding factored.

- In the context of a leveraged buyout (LBO) transaction, the minimum IRR is usually 20%.

- Internal Rate of Return (IRR) = (Ending Value ÷ Current Value) ^(1 ÷ Number of Periods) – 1

- Internal Rate of Return (IRR) = MOIC ^ (1 ÷ t) – 1

MOIC stands for “Multiple on Invested Capital” and measures investment returns by comparing the value of an investment on the exit date to the initial equity contribution.

- The MOIC is metric is used to track the performance of an LBO investment and to perform a comparative analysis of a fund’s returns.

- Multiple on Invested Capital (MOIC) = Total Cash Inflows ÷ Total Cash Outflows

- Multiple on Invested Capital (MOIC) = Exit Equity Value ÷ Initial Sponsor Equity

Step 5. LBO Sensitivity Analysis Table

In the final step, different operating cases must be considered—e.g. a “Base Case”, “Upside Case”, and a “Downside Case”—along with sensitivity analysis to assess how adjusting certain assumptions impacts the implied returns from the LBO model.

- Base Case ➝ The outcome with the highest probability of occurrence.

- Upside Case ➝ The most optimistic outcome, where performance far exceeds expectations.

- Downside Case ➝ The most pessimistic outcome, where performance fails to meet expectations.

Private Equity Benefits

- Access to Capital: Private equity provides companies with significant capital resources needed for expansion, acquisitions, and other strategic initiatives.

- Expertise and Strategic Guidance: Private equity firms bring experienced management teams and strategic insights to their portfolio companies, helping to drive growth and operational improvements.

- Operational Improvements: Through active management, private equity firms enhance the operational efficiency and profitability of their portfolio companies, often leading to substantial value creation.

- Long-Term Perspective: Private equity investments typically have a long-term investment horizon, allowing for substantial operational and strategic changes without the pressure of quarterly earnings reports.

Risks and Challenges

- High Leverage: Buyouts often involve significant debt, increasing financial risk if the company’s performance does not meet expectations.

- Market Risk: The success is subject to market conditions and economic cycles, which can impact the valuation and exit opportunities.

- Management Risk: The ability of the management team to execute the business plan is crucial. Poor management can lead to suboptimal performance and reduced returns.

- Regulatory and Compliance Risks: Complex regulatory environments and ensuring compliance with legal standards can pose significant challenges.

Conclusion

Private equity plays a crucial role in the global financial ecosystem, providing capital and strategic support to companies at various stages of development. While the potential for high returns is significant, it is accompanied by substantial risks. Successful private equity investments require careful selection, thorough due diligence, active management, and well-planned exit strategies. As the industry continues to evolve, private equity will remain a critical driver of economic development and corporate transformation.

References

1. Kaplan, S. N., & Strömberg, P. (2009). Leveraged Buyouts and Private Equity. Journal of Economic Perspectives, 23(1), 121-146.

2. Metrick, A., & Yasuda, A. (2010). The Economics of Private Equity Funds. The Review of Financial Studies, 23(6), 2303-2341.

3. Gilligan, J., & Wright, M. (2020). Private Equity Demystified: An Explanatory Guide (3rd ed.). ICAEW Publishing.

4. Gompers, P., Kaplan, S. N., & Mukharlyamov, V. (2016). What Do Private Equity Firms Say They Do? Journal of Financial Economics, 121(3), 449-476.

5. Wall street Prep : Private Equity Basics of an LBO Model

6. Harvard Business Review: The Strategic Secret of Private Equity