Business Valuation

Determining a fair market value (“FMV”) for investment, sale or acquisition is one of the most important aspects of the M&A. Hence, selecting valuation methodologies and accurately formulating the data and following a proven framework becomes extremely critical. The valuation methodologies assist investors, analysts, and corporations in making informed decisions by offering insights into of a company, its assets and operations. The valuation process must include estimations of the present value of future cash flows, prevailing market conditions, and comparing performances of similarly company’s and assets, thereby ensuring a comprehensive understanding of an entity’s worth.

Relative Value Approach

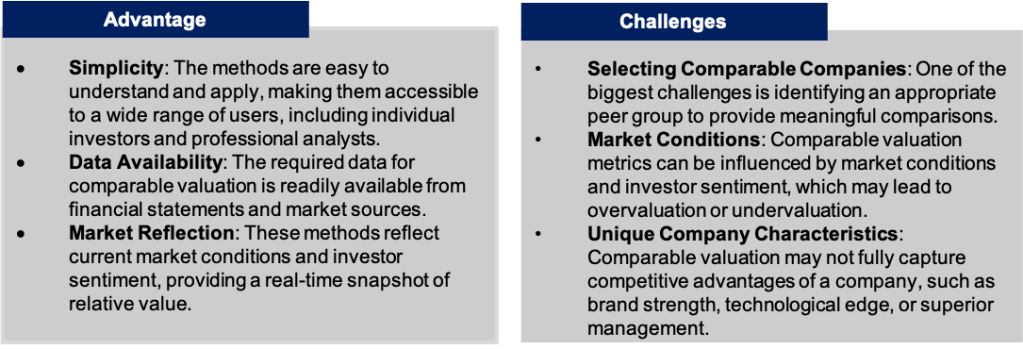

One of the commonly used valuation methodology is known as the “Relative Value Approach”. In this approach the “FMV” is derived by comparing it to a collection of similar companies and/ or assets, referred to as a “peer group.” These methods are based on the principle that similar companies, or assets with similar characteristics, should have similar valuations. By leveraging comparative metrics, investors and analysts can assess whether a company is overvalued or undervalued relative to its peers. This comparative analysis provides a benchmark for making informed investment decisions.

Additionally, this approach helps to identify market trends and anomalies by highlighting discrepancies in valuation multiples. It allows for a more dynamic assessment as market conditions change, providing a real-time perspective on the asset’s relative standing.

Valuation Multiplier

Valuation multiples are ratios that reflect the implied value of companies and relate a company’s market value to an aspect of its financial performance, such as earnings, sales, or book value. They are widely used in relative valuation methods, providing a quick and practical way to assess a company’s value.

Valuation Multiplier = Valuation Measure/Valuation Driver

- Value Measure – Enterprise Value or Equity Value

- Value Driver – Financial or Operating Metric like EBITDA, EBIT, Revenue, etc.

Valuation multiples offer a simplified and comparable way to assess value across companies within the same industry. By comparing these multiples against those of the peer group, analysts can gauge a company’s valuation relative to its competitors, providing insights into its financial health and market position.

Moreover, valuation multiples are crucial in understanding the relative performance and efficiency of a company. This comparative framework helps in constructing a holistic view of a company’s market standing and strategic potential and can be particularly useful in identifying investment opportunities and making informed, timely decisions.

Note – EV/EBITDA multiple is the most commonly used, followed by EV/EBIT, especially in the context of M&A.

Comparable Company Analysis

Comparable Company Analysis is a relative valuation method in which a company’s value is derived by comparing it to similar publicly traded companies. Once the peer group of comparable companies and the appropriate valuation multiples have been established, the median or mean multiple of the peer group is applied to the corresponding metric of the target company to arrive at its comps-derived valuation. This method relies on the principle that companies operating in the same industry and with similar characteristics should be valued similarly. Here are the detailed steps involved in performing a comparable company valuation:

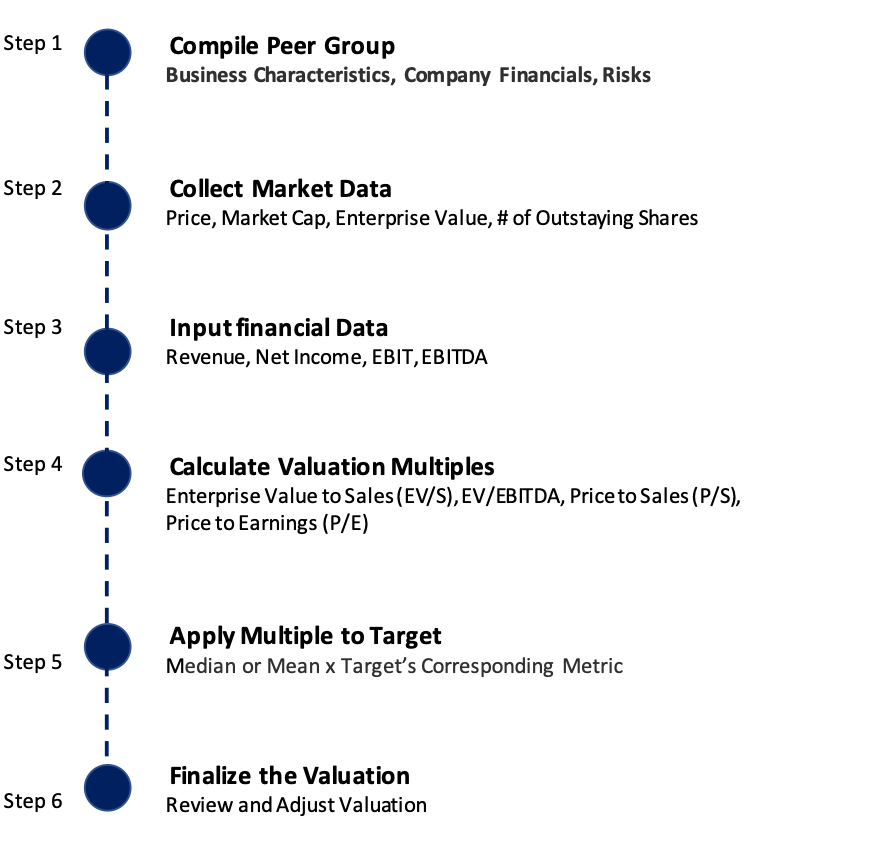

Steps in Comparable Company Analysis Valuation

- Compile Peer Group: The first step is identifying a set of comparable companies, known as the “peer group.” These are companies that operate in the same industry and have similar characteristics, financials (e.g., cash flow drivers), and risks.

- Business Characteristics: Product/Service Mix, Customer Type

- Financials: Revenue Growth, Operating and EBITDA Margins

- Risks: Changes in Regulatory Landscape, Competitive Landscape

- Collect Market Data: The next step is to gather applicable information from publicly available sources for the peer group and target companies. This includes Price, Market Cap, Enterprise Value, and the number of Outstanding Shares.

- Input Financial Data: Collect the financial data of each comparable company, including Revenue, Net Income, EBIT, and EBITDA.

- Calculate Valuation Multiples: Calculate valuation multiples such as Enterprise Value to Sales (EV/S), EV/EBITDA, Price to Sales (P/S), and Price to Earnings (P/E). These multiples are compared against one another and typically displayed on a last twelve months basis. The minimum, 25th percentile, median, mean, 75th percentile, and maximum of each metric are also calculated and summarized.

- Apply Multiple to Target: Arrive at the valuation of the target by applying the median and mean multiples derived from the peer group of comparable companies to the target’s corresponding metric.

- Median: Preferable option with higher comparable companies as using the median removes the distortion caused by outliers.

- Mean: Preferable option when the peer group is comprised of only a few comparable companies (i.e., <5) with no clear outliers.

- Finalize the Valuation: Review the valuation results and adjust if necessary based on qualitative factors or additional information. Consider the overall market conditions, industry trends, and specific circumstances of the target company.

In conclusion, performing a comparable company valuation involves a systematic approach to selecting peers, gathering financial data, calculating and analyzing valuation multiples, and applying these multiples to estimate the value of the target company. By comparing a company’s financial metrics to those of similar companies, this method provides valuable insights into its market positioning and valuation.